Moorabool Shire Long Term Financial Plan

Project Overview

Why do we have a Long Term Financial Plan?

The Local Government Act 2020 requires Council to take an integrated approach to strategic planning and reporting. As part of this integrated strategic reporting and planning framework, a Council must develop, adopt and keep in force a Financial Plan with an outlook of at least 10 years. A Long Term Financial Plan provides a vital tool for Council. The importance of the plan includes:

- It is a 10-year view of our income and expenses.

- It contains our proposed rates and borrowings for the next 10 years.

- It incorporates the projected financial impacts of the Council Plan actions and the Community Vision.

- It seeks to address risks associated with:

- Our financial viability; and

- The management of our current and future liabilities.

We review the Financial Plan yearly, ensuring that we stay on track to be able to deliver on what we’ve set out to achieve.

It is important to note that we aim to deliver on the plan, however with various assumptions over the 10 year period, a reduce degree of certainty exists as we approach 10 years. That’s why we update our estimates as we go through various stages of planning and procurement.

What is a Long Term Financial Plan?

A Long Term Financial Plan provides a financial view for the next 10 years for Council. These views include:

- What we will do

- How much it may cost

- How we can fund it

We want our community to understand how the Financial Plan is structured, the decisions involved and where the money goes to deliver services to the community.

We have an obligation to our future community, and we want to ensure we can respond to future events, opportunities and pressures.

Aims of the Long Term Financial Plan?

The aim of a Long Term Financial Plan is to express in financial terms the activities that Council proposes to undertake over the medium to longer term to achieve its stated objectives. It helps guide Council’s future actions depending on longer-term revenue and expenditure proposals. The plan has a strong alignment with the Council Vision and the Council Plan and also highlights key forces that has the potential to materially impact long term objectives.

Highlights of the Long Term Financial Plan?

- Operating results trend in later years is to remain at an acceptable level. The Adjusted Underlying Result indicates the sustainability of operating result required to enable Council to continue delivering core services in the long term and meet its objectives.

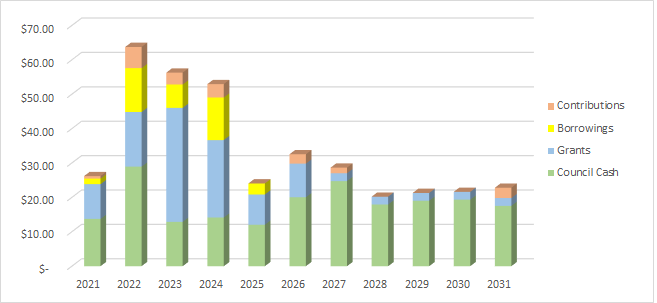

- Unrestricted cash is expected to increase in 2021-2022 and is on a declining trend over the follow year of the Financial Plan, with a steady increase thereafter. This is a result of necessary increased costs in service and infrastructure delivery required for our existing, growing and new communities. Council will be proactive in delivering best value services whilst improving this indicator.

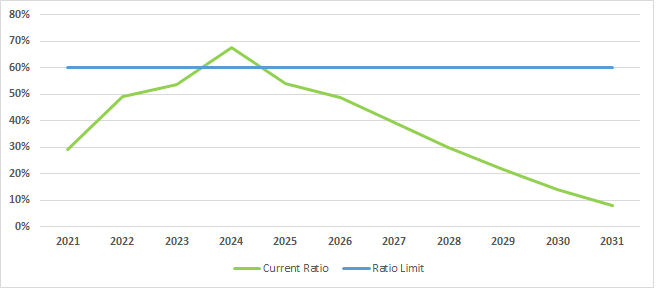

- Trend indicates Council’s reducing reliance on debt against its annual rate through redemption of long term debt. Council’s current plan includes borrowings for capital expenditure. Council’s indebtedness ratio will peak in 2023-2024 at 67.54%, however this ratio will fluctuate dependent upon Council’s borrowing and capital works requirements and will be refined each year as further borrowings are identified and utilised to delivery infrastructure to the community.

How has the draft Long Term Financial Plan been developed?

Council ran a deliberative engagement program between December 2020 and March 2021 to identify the opinions and expectations of our community for the next ten years. In order to gain a wide range of insights during the interactive workshops, Council established a Community Reference Group that reflected the diverse groups within our municipality.

The insights gained during the deliberative engagement workshops and broader consultation helped Council shape the Community Vision 2030 whilst providing the medium to long-term direction of how the community sees the municipality in ten years’ time. The development of the draft Long Term Financial Plan 2021 - 2031 has been informed by the Community Vision 2030 and contains the financial resources required to deliver our strategic objectives over the next 10 years.

The preparation of a long-term financial plan generates improved information to guide Council’s decisions about the mix and timings of outlays on operating activities and additional assets and the funding implications of these. Without a sound based long-term financial plan, the Council with its significant asset management responsibilities is unlikely to have sufficient data to determine sustainable service levels with affordable asset strategies, appropriate revenue targets and treasury management.

Long Term Financial Plan

1. Where does the money come from?

2. Indebtedness Ratio

3. See where the money goes

4. Capital Works Expenditure

5. Funding Sources - Capital Works Expenditure

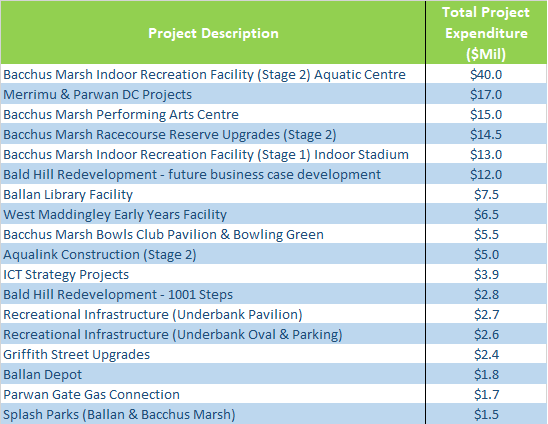

6. Project Names

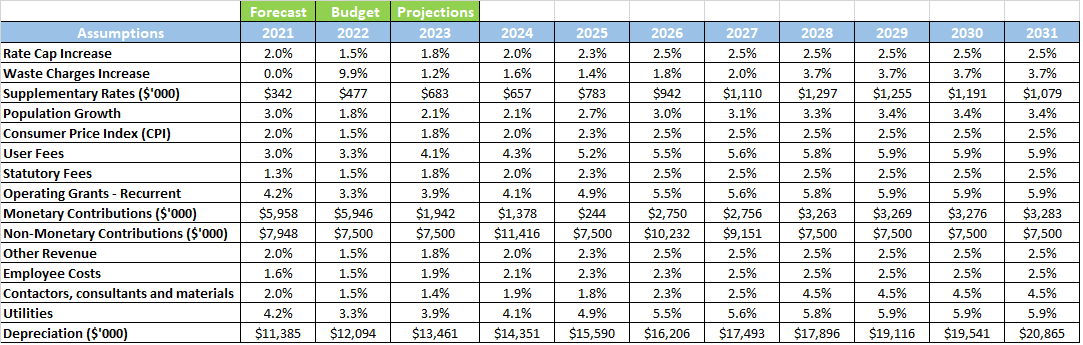

7. Assumptions

-

Deliberative community engagement

Deliberative community engagement -

Moorabool Shire Community Vision exhibited and adopted

Moorabool Shire Community Vision exhibited and adopted -

Council Plan 2021 - 2025 exhibited and adopted

Council Plan 2021 - 2025 exhibited and adopted -

Exhibition of draft Long Term Financial Plan

Exhibition of draft Long Term Financial Plan -

Adoption of Long Term Financial Plan

Adoption of Long Term Financial Plan27 October 2021

.png)

.png)